– Working as a full-time freelancer comes with a number of freedoms. The freedom to work when you want, where you want, and with whom you want.

Working as a full-time freelancer comes with a number of freedoms. The freedom to work when you want, where you want, and with whom you want.

However, with all of those freedoms comes more financial responsibility. You are responsible for your own overhead and taxes, all without a regular bi-monthly paycheck.

The reality of freelancing is one of flexibility. But your income (or cash flow) will not have the same stability.

So, how do you prepare for the financial reality of freelancing?

With the skill of budgeting.

Page Contents

Why are budgets important for freelancers?

As mentioned before, your income is less predictable when you’re a freelancer. This is for two main reasons. The number of projects you have each month changes AND different client pay at different times.

Unlike receiving a regular paycheck as a full-time employee, you might have some clients pay each week or each month. Some might not even pay until after your work is published, which could be months after you submit it.

And, the truth is that not all clients will pay on time.

So, you know that your income changes. But, your expenses will still be there. Your landlord or bank won’t be concerned that your client paid you late.

Creating a budget allows you to support yourself in the leaner months. It also helps you decide what to do when you earn more than projected.

In addition to normal expenses, you may find that you have debt for education, credit cards, or home and vehicle purchases.

A budget empowers you to pay off debt, reach your financial goals, and be prepared in an emergency.

And finally, learning how to budget is an essential skill for any business owner. You may not be passionate about business, but creating a profitable freelance business will allow you to continue doing the work you are passionate about.

What is a budget?

A budget is a spending plan that’s based on your estimated income and expenses. They are usually created for a certain period of time, for example, weekly, quarterly or yearly.

This article will walk you through the basics of creating a budget to suit your freelancer lifestyle. At the end, you’ll know where to allocate your money and what you need to be prepared for financially.

Estimating Income and Expenses

Before you determine your income goals, you need to know your financial reality. This can be an uncomfortable step.

Before you determine your income goals, you need to know your financial reality. This can be an uncomfortable step.

You might be worried to look at your bank account or credit card statements, but do it anyway. The only way to change your financial situation is to look at it realistically.

Calculating Cost of Living

Your financial reality begins with your cost of living. To get started, write down your monthly fixed expenses, your essentials. This includes

- Rent/mortgage

- Utilities payments

- Subscriptions/memberships

- Insurance

- Minimum debt repayments (monthly)

- Groceries estimate

Since most of your payments are due each month, we use one month as the basis for establishing a budget.

If you have expenses that aren’t paid monthly, you can calculate the monthly payment. For example, if you pay car insurance every 6-months, divide by 6 to get the monthly amount.

Since your income is variable, it’s important to keep expenses fixed if you can. You want one less thing to have to predict.

Once you have all of these monthly expenses estimated, add them up to get your total monthly cost of living.

Estimating income

If you’re a full-time freelancer already, you can get a general estimate of your monthly income. But, if you’re getting started, you want to set a goal for your monthly income.

There are a few ways to do this. First, you can base it on your full-time salary. If you want to quit your job to freelance, your minimum income goal can be to match your existing salary.

Or you can use your expenses to estimate your income.

Your essential costs (which you already calculated) should be about 50% of your after-tax income.

Now, this can be a bit complicated too. As a freelancer, your taxes are not automatically taken out of your payments.

As a rule of thumb, estimate that about 30% of your total income should go to taxes.

To get your minimum income, use the following formula:

Minimum monthly income = Cost of Living * 2.86

(If you want a conservative estimate, then multiply by 3.)

As an example, let’s say your cost of living = $4,000. Then your minimum income goal (total before taxes) is $11,440 (or $12,000 for a conservative estimate.)

Adding in your goals

The last thing to do before creating your spending plan is to write down your long-term financial goals.

This might include travel, purchasing a house or car, or paying off debt early.

Try to add goals that have a defined timeline. Once you have your main goal, you can break it down into how much money you want to save each month towards that goal.

With budgeting, it’s easier to make adjustments once the bike is in motion. With that in mind, keep it simple at the beginning. Try to include only one big goal, maybe two.

Creating Your Spending Plan

Now that you have your financial reality in front of you, it’s time to look at where your money goes once you get it.

There are several budgeting philosophies out there including the zero-based budget, the pay yourself first budget, and the envelope budget.

Feel free to explore these methods, but for our purposes we’ll be using the 50/30/20 rule. We’ve chosen it because it’s

- Simple

- Flexible

- Good for big picture financial wellness

The 50/30/20 budget spending plan divides up your after-tax income into the following categories:

- 50% of income goes to essentials (ie. your cost of living)

- 30% of income goes to your “wants”

- 20% of income goes to savings or reducing debt

This is how we calculated Minimum Monthly Income above.

This article will use the original rules of thumb. However, you might find that different percentages work for you and your business. In that case, you have the freedom to adjust your categories.

However, remember that at least 20% should always go to savings/debt reduction.

If you have larger goals such as buying a house, then you may allocate more money to savings until you reach that goal.

If you have larger goals such as buying a house, then you may allocate more money to savings until you reach that goal.

One more thing to think of is how you categorize investing in your own business or learning. You can choose to include that in either your essentials or your “wants” category.

Just remember to include it somewhere.

What your budget should include

Now, within the savings and debt reduction categories, there are certain types of savings to account for.

You have the big goals that you already calculated, but you will also have other categories that you’re saving towards.

Your full list of savings categories should include:

- Big goals (debt, property, etc.)

- Retirement

- Emergency funds

- Travel (if this is a priority for you)

You don’t need to be contributing to each of these every month. For example, once your emergency fund is full, you can put more of your savings towards retirement.

However, it’s good to have more than one type of savings “fund” with its own spending rules. This will keep you from spending your retirement money on a car or your emergency funds on travel.

Setting Priorities that Support your Goals

Your priorities will change over time, and so, the way you allocate money will change over time. If you use the 50/30/20 rule, you’ll ensure that you always cover your cost of living.

Your priorities will change over time, and so, the way you allocate money will change over time. If you use the 50/30/20 rule, you’ll ensure that you always cover your cost of living.

The rest of your earnings will then be divided between your goals and your wants. If you’re younger, retirement might not be your biggest priority. Therefore, you can make smaller contributions.

Once you own your car, apartment or house you can take that money and begin allocating it to retirement.

You may also choose to forego personal wants to invest in your business or education. It’s all up to you.

All in all, remember that your values are reflected in how you allocate your money.

Revisit your 50/30/20 rules regularly to make sure that your money and your priorities line up. We suggest every year you should reflect on your values and adjust spending rules as needed.

Setting Up Different Bank Accounts

Just because you set up a budget, doesn’t mean you’re automatically going to follow it. It can be hard to stick to a spending rule when the money is sitting right in front of you.

On the contrary, it’s easy to save money if you’re not tempted to spend it in the first place.

This is why we recommend setting up a business bank account separate from your personal bank account.

The business account will be the place you collect all of your payments from clients. It will also be the account that you pay your taxes from.

For more information about taxes, check out our Guide to Freelancer Taxes.

With a business bank account, you’ll have a clear record of all your income. Then, you can set a schedule to allocate the funds. Every two weeks or once a month is recommended.

First, begin by keeping 30% of your earnings in your business account for taxes.

Once you calculate the remaining income, then 80% can go to your personal account to be split between wants and essentials. The other 20% of your post-tax income will be divided between your savings accounts and extra debt payments.

If your income tends to be more predictable, you can set up automatic transfers or withdrawals to your personal account. However, be careful that you don’t incur overdraft fees if you have a slower month.

In the end, choose the method that makes you the most comfortable.

Best Budgeting Tools

In addition to setting up separate bank accounts, there are several tools that can help you create your budget and manage your money.

A few of our personal recommendations are listed below. Our team has personally used/tested all of the recommendations below, unless noted.

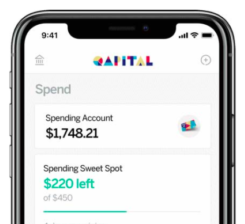

Qapital

Qapital

Qapital is a mobile banking app that helps you separate your money into different accounts. For example, you can have separate savings accounts for emergency funds, retirement, and travel. While they do have a free membership option, you can opt for a monthly subscription tier if you want help with investing and big goal saving. Try Qapital today and get $25 when you use our link.

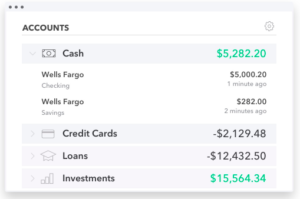

Mint

Mint makes it easy for you to balance your finances in one place. You can link your bank accounts, credit cards, and loans to get the full 360-degree view of your money. With Mint you can add budget rules, schedule reminders for bills, and discover money-saving insights. It’s free to create an account.

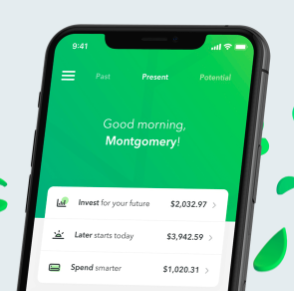

Acorns

Acorns

Acorns is an online platform/mobile app that helps you invest your money easily. You can manually deposit money or set up regular deposits. You can also earn cash-back on purchases made online through the app. Once your money is in, you select a portfolio based on the level of risk and Acorns does the rest. Their premium plan also includes retirement savings and a debit account. Sign up with our link and they’ll invest $5 in your account.

Quickbooks Self-Employed

Quickbooks Self-Employed is the affordable tax solution for freelancers, independent contractors, and sole proprietors. With their software you can create and send invoices, separate business expenses from personal, and maximize your tax deductions. This is especially helpful for estimating your quarterly taxes automatically. Check out their pricing here. (Our team has not personally vetted this solution, our recommendation is based on this review from softwareadvice.com.)

No matter what budgeting style you choose, there are plenty of tools to help you automate your money management.

We recommend sticking with no more than three at the beginning to keep it simple. Before you automate, take 2-3 months to manage everything by hand first. This lets you know which parts of your finance are predictable enough to automate.

In Conclusion

Managing your money as a freelancer can be a big pain if you don’t take the time to plan. You may never be able to predict your income accurately, but that doesn’t mean you can’t master your finances.

Creating a budget is an essential skill of any freelance business owner. It will save you hours of worry and extra work.

With a well-planned simple budget, you can support your life and your goals while freelancing.